I love teaching (Although I hate grading, but that’s why I invested in Gradescope. More on that some other time). Every time I interact with students, I find myself repeating the same contrarian advice to them over and over again. So I figured I should write up a quick post so that I can point students to it and also have it hopefully reach more students than I get to interact with one on one.

(For context, I am talking mostly to Computer Science and Engineering grads from the top schools who are looking at opportunities at tech companies. This post may not apply to students graduating from other disciplines or schools as directly, i.e. YMMV.)

#3: Your resume does not need to be just 1 page!

Yes, you read it correctly. I don’t know why this myth of a one page resume refuses to die and keeps perpetuating itself. Yes, your resume should be at least one page — if you haven’t done enough to fill up a page, then you probably need to consider expanding on what you have done, or in some cases you may simply need to do more stuff and build up more experience.

But in most cases, I constantly find people who are “choosing” what to put on their resume and what to leave out. My advice to them is don’t choose. Present yourself in the best light possible, with as much detail as you would like to provide, without subjecting yourselves to “page constraints.”

We live in a digital age. Your resume is not ending up in a paper file any more. It is almost always going to be sent, received, and reviewed electronically. In most cases the resume will end up in a resume bank, which will also be searched electronically. So if you really want to optimize your chances for showing up in search results and also being reviewed more favorably, then provide more detail than less. You should be thinking about keywords and SEO for your resume as that is how people search and filter.

This doesn’t mean that you start writing essays in your resume. It should still be punchy and to the point. Preferably bullet-points and not prose. I also advise not use adjectives in your resume to self promote and instead let your training, education, work, experience, and interests speak for themselves. Include references in your resume. Also make sure that your LinkedIn profile is up to date and is consistent with the information on your resume and your CV.

#2: You will learn more at a small company than at a big company

A lot of students think that because they don’t have a lot of experience they should go and work at a big company first so that they can learn from other more experienced people on the job. That may be true in very unique situations where apprenticeship models work, for example if you’re going to be a doctor, a surgeon, an architect, an electrician, or a carpenter. Then apprenticeship is a brilliant way of learning the stuff that you don’t learn in school.

Here’s the thing that most students don’t realize about big tech companies — they very often *don’t* have their processes and structures in place. You spend most of your time navigating bureaucracy rather than learning how to do real work. Or put differently, you may spend a lot of your time learning things that don’t have a direct impact on the work you have to do or want to do.

As a company gets bigger roles get more specialized. At a large company you may get to work on a tiny little feature of one little corner of the overall product. If you really want to have an impact and don’t want to be pigeon-holed, then you have to make the effort to find a smaller company that will give you the opportunity to take on more responsibility that you originally joined them for.

In most startups, there simply aren’t enough people to do all the work that needs to be done and so if you show an active interest and even a modicum of ability to do something, there is a good chance that you will get the opportunity to try. In fact if you look at the paths that some of the most senior people in your favorite tech companies took to get there, that was it — they happened to join the company when it was really small and then they grew into the role that they are in today.

So my advice (and of course I am biased in saying so, but I will say it any way) is to say, Go small. Finding a small company is much harder than finding a large company as they don’t typically have the resources (time, money, and people) to participate in campus recruiting. So it’s really up to you to take the initiative to research and reach out to people who can connect you to these companies.

I’ll go as far as offering that if you’re in the top decile of your class in Computer Science, Electrical Engineering, Computer Engineering at Stanford, Berkeley, MIT, Carnegie Mellon, University of Michigan, Cornell, Princeton, Waterloo, University of Washington or other school that has a top rated Computer Science/EE/CE program you’re welcome to email me directly.

#1: Never sign an offer in the Fall! Wait till *late* Spring.

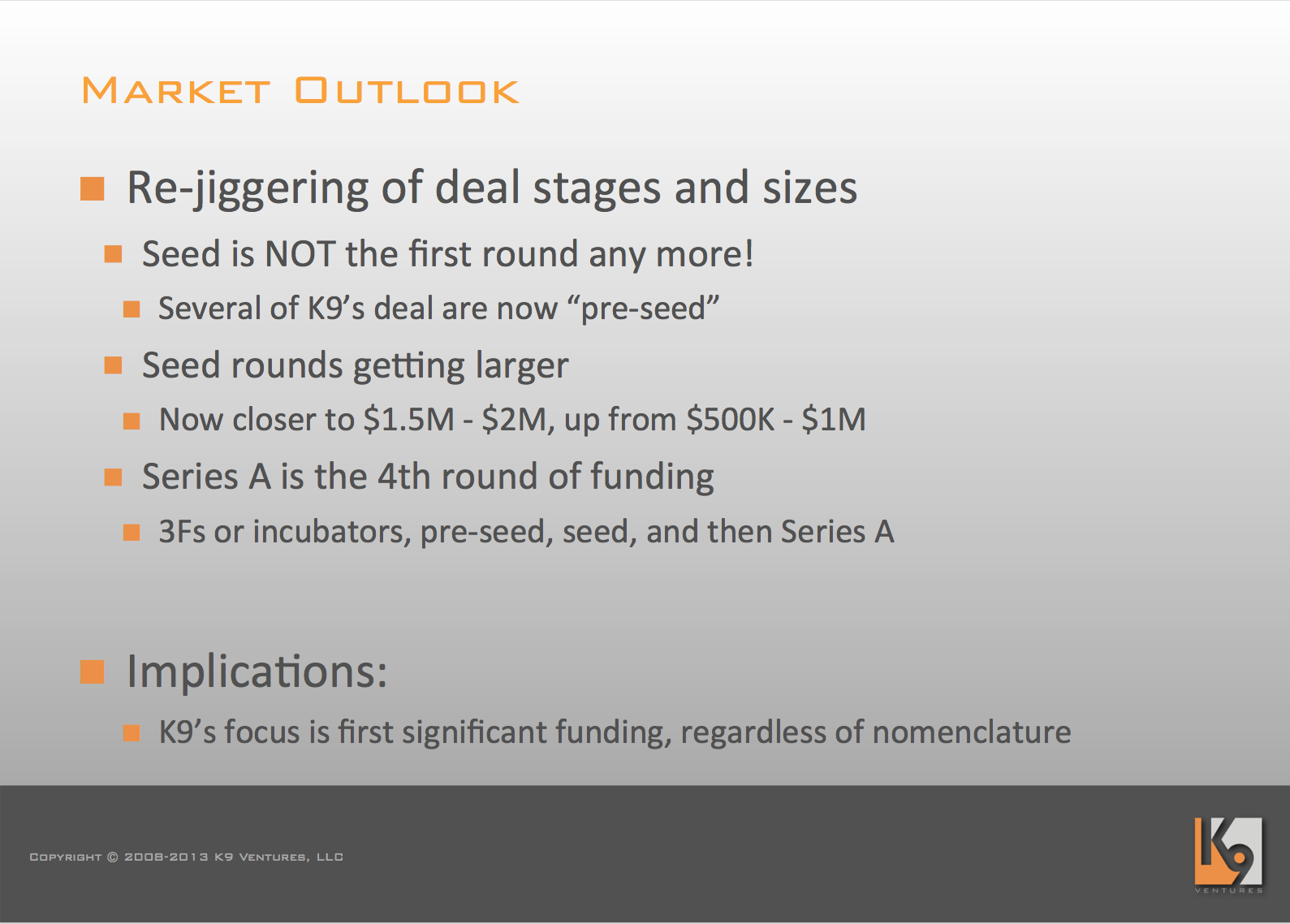

This is probably the single biggest dirty little secret of college recruiting. At some point companies figured out that there is intense competition for the top candidates if you try to get to them in the Spring, right before they graduate. So some of these companies decided that they would start their recruiting process in the Fall. Yes, in the Fall — before you graduate from school, as you enter your Senior year, instead of focusing on the 1/4 of the time that you have left in school you now have to think about resumes, job fairs and interviews. And colleges and universities actively permit and promote companies coming to recruit students in the Fall. What a complete boondoggle in my opinion.

Notice that the companies that are typically recruiting in the Fall semester/quarter all tend to be large established companies. These companies know that they will need to hire people at a steady clip and so they’re willing to come in and make attractive offers in the Fall semester and wait for 6-9 months before you actually get to start your job. What they’ve effectively doing is taking you off the market and limiting your options.

Some students think that they will just get their job search behind them and then not have to worry about it. But what happens if you accept an offer in the Fall and then come January, February or March, you find something you really, *really* like more? There’s the moral imperative that you’ve already committed and don’t want to renege on your commitment. So most students either shut themselves off from other options or just suck it up and go to the job they agreed to take already. In my opinion, there is almost little to no benefit for a student to accept a job offer in the Fall. I constantly counsel students against doing this.

Consider the inverse of this situation. What happens if the economy tanks and the company decides that it cannot hire as many people? Will they still have that job position waiting for you come July? Sorry, but you’re out of luck there. This has already happened anytime there is a downturn (especially in 2000 and then again in 2009). Students who had signed job offers end up being told that they don’t have a position any more.

Students often counter with “But <large company> says my offer is only valid for 1 week” or “They told me I have to decide by tomorrow.” Well, here’s the dirty little secret of college recruiting — it’s the same as the dirty little secret of venture capital. The same way that there is no such thing as an “exploding termsheet” in venture capital, similarly, there is no such thing as an exploding job offer from a big company doing campus recruiting in the Fall. If they think you’re good enough to hire in the Fall, there’s a damn good chance that they will think you’re good enough to hire in the Spring! Heck, you’re probably a tad smarter and more experienced in the Spring than you were in the Fall!

So my advice to students is to call their bluff. Simply tell the college recruiter who is pestering you to sign that offer letter that you’ve decided to wait till the Spring before signing. You still like their company and would love to work there, but would like to request that they keep the offer open till the Spring. Some will say okay, some may play hardball and tell you that that’s not possible. If they do the latter, then you have to decide whether you have the guts to call their bluff.

I would tell them that, “If you’re ready to have me now for a position that you expect to have open 9 months from now, then surely you will have similar positions in the future too?”; “What guarantee can they provide that this position will still be there in 9 months?” and, “If you think I’m qualified enough to hire now, then wouldn’t I be just as qualified or more in the future?”

When you’re a student about to graduate, finding your first real job is stressful. And so it’s tough for students to play hardball with recruiters who are professionals and play this game every day. The balance of power is not in your favor. But I’ve seen this game play out in the startup space. The balance of power used to be with the investors; but with the increase of freely available information about startups and fundraising, the balance of power is now with founders — where it should be. The same information revolution needs to happen with college recruiting. Students need to be aware that big companies coming to recruit them in the fall are taking advantage of the students’ fear of ending up without a job when you graduate. And so they try to lock you up and get you off the market as quickly as they can.

Students need to understand that if they are coming from a top Computer Science and Engineering program — they will have options. But they need to do a little leg work to uncover them and find the best match for themselves. Don’t take the first offer presented to you and become a cog in some giant corporate machinery.

I thought I only had three things to say but here are 2 small bonus items:

Bonus #1: For heaven’s sake don’t waste your time on Wall Street, Consulting, or Investment Banking. This is my own personal bias, but I have said it many times that “Anytime I hear a top CS student tell me that they’re going to work at a big investment bank or consulting company, all I can think of is what a waste of a good brain.”

Bonus #2: If you’re ever considering doing a startup, the best time for you to do a startup is right after school (provided you have an idea that you’re passionate about), when you haven’t amped up your personal burn rate and lifestyle. And in case your startup idea doesn’t work out, then you can always go back to looking for a job then. You won’t be any less qualified, and if anything most tech companies will value your attempt to do something on your own as you would have learned valuable lessons from that experience.

To all the students out there doing this for the first time… wish you all the best and although it’s easier to follow the process and the timeline set out for you, I encourage you to be bold and create your own path.

You may also follow me on @Twitter at @ManuKumar, and for all things @K9Ventures K9 Ventures is also on Facebook and Google+.

The post 3 contrarian pieces of advice for graduating students appeared first on K9 Ventures.

But the same video needs to be cut and recut to create a 30 second version that is catchy within the first 2-3 seconds so that it can attract someone’s attention in the social media feed (Hat tip to

But the same video needs to be cut and recut to create a 30 second version that is catchy within the first 2-3 seconds so that it can attract someone’s attention in the social media feed (Hat tip to

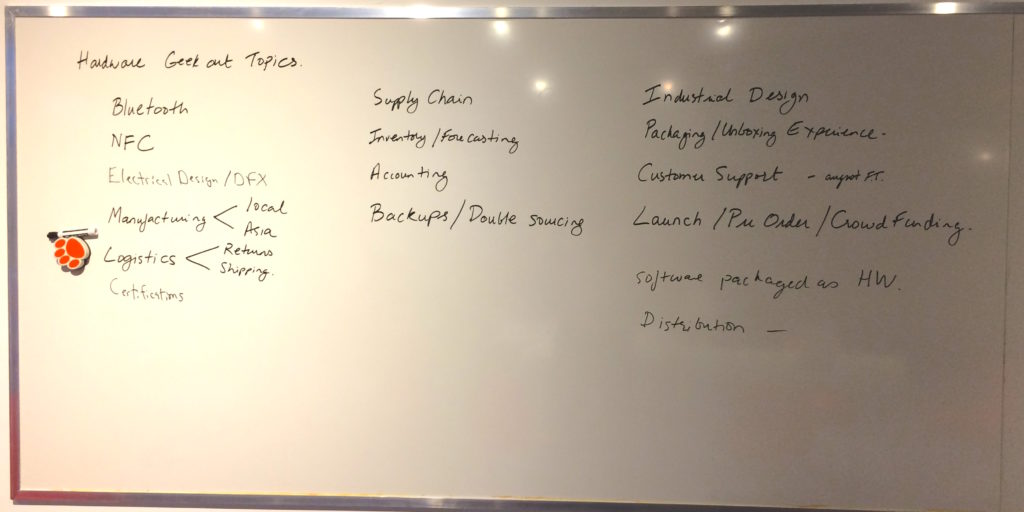

But, to this day, the paper business card has persisted and survived. I’m inclined to declare that business cards are the cockroaches of information exchange — relics of ancient history and a nuisance in the modern age. I don’t like cockroaches. And, I really want the experience of exchanging contact information to be far more seamless than trading phones and manually typing in our number or email address.

But, to this day, the paper business card has persisted and survived. I’m inclined to declare that business cards are the cockroaches of information exchange — relics of ancient history and a nuisance in the modern age. I don’t like cockroaches. And, I really want the experience of exchanging contact information to be far more seamless than trading phones and manually typing in our number or email address.